Jumbo Cd

Posted : admin On 4/10/2022A certificate of deposit, more commonly known as a CD, is a type of bank account that pays interest in exchange for the depositor leaving their funds in the account until it matures. A jumbo CD functions in the same way, though they require a higher minimum balance to open. Interest rates are usually fixed, though some accounts offer variable rates or “bump-up” features. Jumbo CDs tend to pay higher interest rates than their standard counterparts. Although you can technically withdraw your money before the maturity date, there’s typically a hefty penalty associated with doing so.

Do you have questions about how to integrate a jumbo CD into your investment portfolio? Talk to a local financial advisor today.

A certificate of deposit is generally seen as a low-risk investment. Two types of CDs are available: basic and jumbo CDs. Both investments work in similar ways. But jumbo CDs require a higher.

- Jumbo CD rates tend to be slightly better than regular CD rates, on average, but these CDs come with a steep requirement. Jumbo CDs traditionally require at least $100,000 to open, though some.

- A certificate of deposit is generally seen as a low-risk investment. Two types of CDs are available: basic and jumbo CDs. Both investments work in similar ways. But jumbo CDs require a higher.

What Is a Jumbo CD?

For all intents and purposes, a jumbo CD is exactly the same as a normal CD. You start by depositing money into the account and, in exchange for leaving your money untouched, you receive a higher interest rate than you would with most savings accounts. Interest is usually compounded in regular intervals (once a day or once a month) throughout the life of the CD.

The main difference between a jumbo CD and a regular CD is that the former typically has very high minimum balance requirements. More specifically, a bank may require you to deposit $100,000 or more at account opening. Interest rates on jumbo CDs are also typically higher than those of regular CDs, which should come as no surprise given the aforementioned minimums.

Pros and Cons of Jumbo CDs

Perhaps the best benefit of a jumbo CD is the fact that you’ll receive a higher interest rate than you would on a normal CD. Since CD rates are already higher than many savings accounts, jumbo CD rates can be especially great.

Jumbo CDs are also a risk-free investment. That’s because they’re insured up to $250,000 by the FDIC. Some jumbo CDs are also offered on a short-term basis, allowing customers with big sums of idle money to earn interest over periods of time as short as a week or a month.

Like any CD, the main drawback of a jumbo CD is the fact that your money is untouchable unless you’re willing to incur a large fee. While those who typically open a jumbo CD are far from short on cash, losing access to as much as $100,000 at once is nothing to scoff at.

Bottom Line

If you have the money to invest in a jumbo CD, it can be one of the best investments you’ll find at a bank. Since they’re available largely risk-free because of FDIC insurance, consider whether they’d be a good fit for your investment portfolio.

Talk with your bank to see what jumbo CD options they have available, if you’re interested in investing.

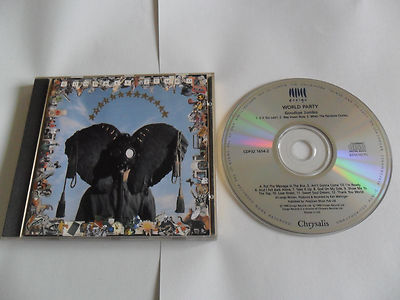

:format(jpeg):mode_rgb():quality(90)/discogs-images/R-10585286-1500402727-9543.jpeg.jpg)

Banking Tips

- In addition to taking care of your banking needs, you should be investing and saving towards retirement. A financial advisor can help you manage these needs, and finding one doesn’t have to be hard. In fact, SmartAsset’s free tool matches you with up to three financial advisors in your area in five minutes. Get started now.

- CDs aren’t the only way you can grow your savings at a bank. Check out SmartAsset’s list of the best savings accounts to find a savings rate that can help you grow your assets.

Photo credit: ©iStock.com/SARINYAPINNGAM, ©iStock.com/LUHUANFENG

Jumbo Cd Rates

A jumbo CD is a certificate of deposit in a very large denomination, usually at a minimum of $100,000. Also called negotiable certificates of deposit, these large investments are considered low-risk, stable investments for large investors.

A jumbo CD has the same basic characteristics as a traditional certificate of deposit. They are considered 'time deposits' because they lock up an investor's principal for a set time period, typically ranging from three months to six years. In exchange for tying up principal, the investor earns a guaranteed return at a set percentage rate locked in at the time of purchase. This return is payable when the CD matures, or reaches the end of the predetermined time period.

Like a traditional CD, a jumbo CD is considered a very low risk investment. Certificates of deposit are FDIC-insured, and therefore guarantee a return of principal. FDIC insurance, however, will only cover up to $100,000 for this type of investment, and therefore most jumbo CDs and any returns are not FDIC-insured. This caveat inherently raises their investment risk to higher than that of a traditional CD.

As with smaller denomination CDs, a jumbo CD can typically deliver a higher rate of return than comparable cash investments such as money market accounts or savings accounts. The certificate rate of return directly correlates to the amount of time that the principal remains locked. The longer that it takes a CD to mature, the higher the rate of return. For example, a six-year CD will carry a higher interest rate than the same amount of principal locked in a six-month CD. Due to the commitment of such large amounts of money, a jumbo CD rate of return is better than that of a smaller CD with the maturity date.

In exchange for a slightly higher rate of return,certificates of deposit do not have the liquidity that other savings vehicles carry. Withdrawing principal early results in penalty fees or a forfeiture of a portion of returns, and those penalties can be particularly severe with a jumbo CD.

Jumbo Cd Rates For $100 000

Due to the large principal involved, jumbo CDs tend to be cash instruments for institutional investors such as banks or pension funds, both organizations with significant capital seeking stable investments. A jumbo CD can also be of value to high-net worth individuals with large cash holdings looking for a guaranteed return without need to access principal in the short term.